5. Auto stop

Concept: stopping the selected algorithms on a fixed loss, if the set values are exceeded. It is possible to set by market type, trading pair or name in the reports. Only losses on closed trades will be taken into account. You can also configure losses «On balance», where all or selected algorithms will be stopped when the balance of the asset decreases by the selected value.

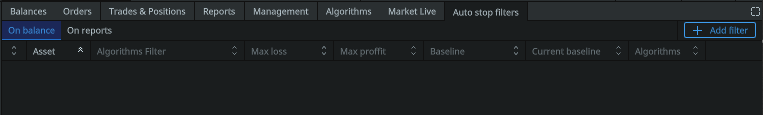

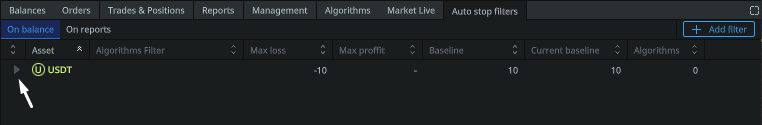

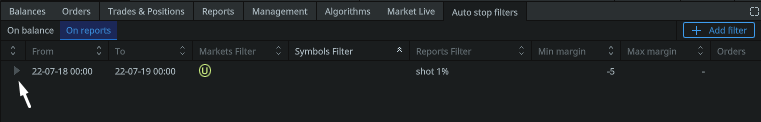

To create a filter, go to the Auto stop filters tab and select the type:

- On balance: stopping all or selected by the algorithm when the balance decreases by a specified value.

- On report: extended version of autostop, where you can select the type of market, trading pair or part of the name from the reports.

Select the type and click Add filter on the right

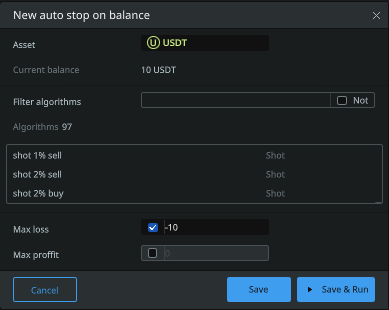

On balance

- Asset: the «coin» asset to which this rule will be applied. For example btc, bnb, usdt.

- Current balance: the rule will be based on your current balance of the selected asset.

- Filter algorithms: specify an algorithm or several (separated by commas), which will be stopped when the specified parameters of profit or loss are exceeded. Also, if you check the box next to «Exclude». — these algorithms will be excluded from the monitoring list. This field can NOT be filled, then the rule will be applied to all algorithms.

- «Window with a list of algorithms» — the list of algorithms that will be stopped when the specified value of profit/loss is reached. This list is set up through — «Filter (by algorithms)». Algorithms that are not on the list will not be stopped.

- Max loss: the value of the loss of the selected asset (for the asset USDT value in usdt) above which the rule will be applied and the algorithms will be stopped.

- Max profit: — the amount of profit of the selected asset (for the asset USDT the value in usdt) above which the rule will be applied and the algorithms will be stopped.

Max profit/Max loss — you can select both filters or use them separately.

If you clicked Save, then it must be run.

To reset the «Reference Point» of the rule, you need to stop it and edit (at the end of the line click on the «pencil»), then re-save and run, then the balance will be updated to the current!

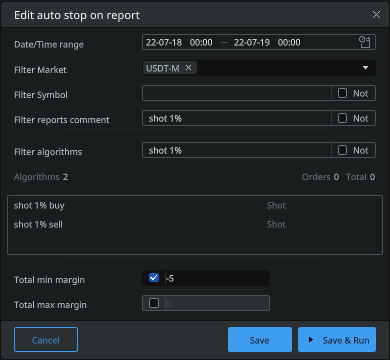

On reports

— / — / — / — / — / — / —

For easier understanding of the principle of setting this rule, visually divide this window into two parts:

- Date/Time range, Filter market, Filter symbol, Filter reports comment

- Filter algorithms

In the upper part of the filters (item 1) you should set the rule to — «WHAT TO WATCH?» and in the lower part (item 2) — «WHAT TO STOP?».

— / — / — / — / — / — / —

- Date/Time range: the range of time in which the rule will work

- Filter market: type of market Spot, Margin, Futures or Quarterly. This item can be left blank, then the rule will work for all markets.

- Filter symbol: you can specify a trading pair or an individual asset. For example, if you specify ETHUSDT, then only this trading pair will be monitored by the rule (you can select several ones separated by commas). You can also specify only USDT, then all trading pairs, where the asset USDT is present, will be monitored. This item can be left blank, then the rule will work for all trading pairs.

- Filter reports comment: you must specify the name, part of the name or type of algorithm. For example, you have four algorithms Shots, with distances of 1% and 2%, which are duplicated in different directions. (shot 1% long, shot 1% short, shot 2% long, shot 2% short). Option 1: You can configure 4 different rules for each algorithm separately, specifying the full name of the algorithm in each. Option 2: You can create 2 rules that work in the direction of the algorithm, where in the first you specify a comma separated list of algorithms in long — «shot 1% long, shot 2% long» or part of the name — «long», and in the second similarly, but with short algorithms. Option 3: You can create 2 rules on the distance of algorithms, where in the first rule you specify the same list of algorithms or part of the name «1%», and the second rule «2%». Option 4: You can specify the type of algorithm — Averages, Shots. This item is not required to fill in, then the rule will be applied to all algorithms.

- Filter algorithms: specify a part of the name or a list of algorithms, separated by commas, which will be stopped after reaching a specified loss or profit. This item is not required to be filled, then all algorithms will be stopped when the specified value of profit/loss is reached.

- «Window with a list of algorithms» — after configuring the filters, this window will display a list of algorithms to which your rule will be applied. Algorithms that are not in the list due to the filters will not be stopped.

- Total min margin: specifies the loss value for the selected parameters, above which the rule will be applied and the algorithms will be stopped.

- Total max margin: the amount of profit for the selected parameters, above which the rule will be applied and the algorithms will be stopped.

Not (exclude) — works according to the reverse principle.

In the items Filter (symbol), Filter (by reports), Filter (by algorithms) — you can check «Exclude», in this case the entered parameters (names) will be excluded from the rule, and the others will be involved. Example 1: If you specified the name of the group of algorithms working to buy «long» in the «Filter reports comment» section (see example in the «Filter reports comment» section), then only algorithms for «short» sale will remain in the rule monitoring. Example 2: point «Filter algorithms» is similar to point 1, only the algorithms that will be stopped.

If you clicked Save, then it must be run.

In order to reset the value in the «Total» column to zero, you should stop it and edit it (click on the «pencil» at the end of the line), then change the «time interval» with the initial date and time to the current ones, where no trades have been made yet. Then save and run.