3. Markets Watcher

Concept: The Markets Watcher algorithm reacts and notifies to changes in the last price compared to its average over a user-selected interval. It can be used as a signal for manual trading or triggering algorithms.

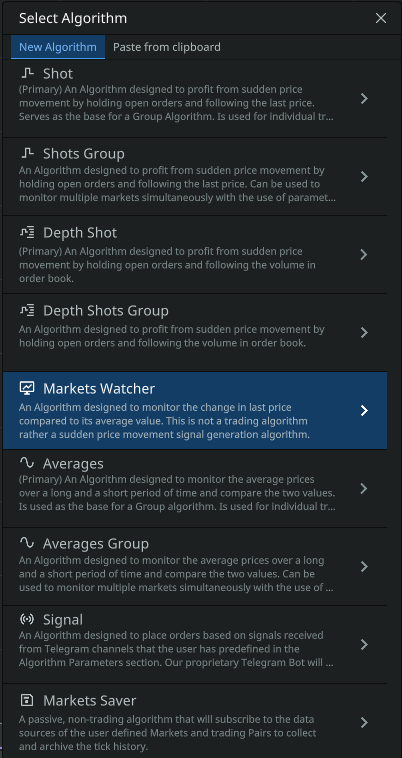

To create an algorithm, click Add Algorithm and select Markets Watcher.

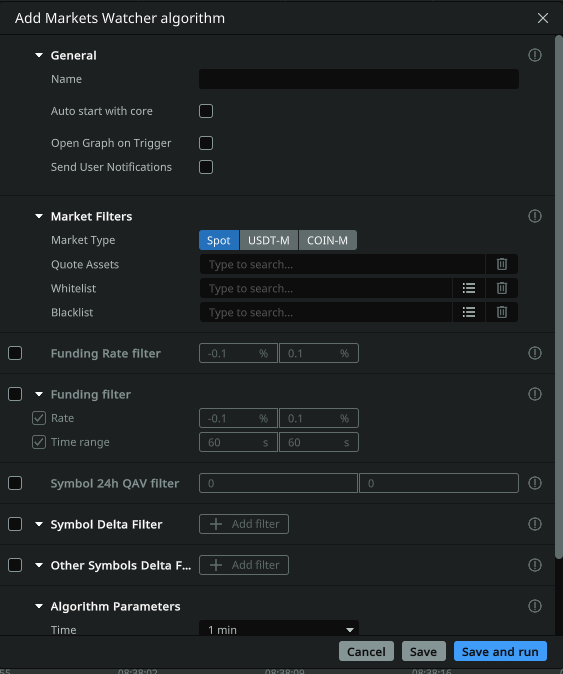

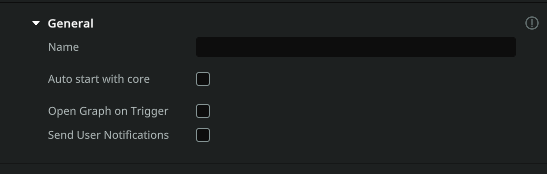

General settings

Set a unique name for the algorithm, for example, with a brief description of its features. Specify the period within which you do not need repeated signals for the same markets.

- Name: specify the name of your algorithm to easily identify it in the full list of algorithms. For convenience, you can specify parameters in the name, for example — «1min/1sec-0.4/0.3-long».

- Auto start with core: the checkbox allows the user to select whether the algorithm will start automatically after the core is started.

- Open graph on trigger: if this option is enabled, the chart of the pair on which the algorithm triggered will be automatically opened.

- Send user notifications: each signal will be sent to your Telegram group. You can find the Telegram bot settings in the MoonTrader general settings.

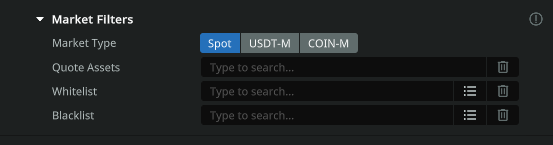

Select the Market Type (Spot/Futures/Coin-M) and the trading pair, or a list of specific trading pairs, separated by commas, which this algorithm will monitor for specific conditions. Markets can be specified as a group of all markets trading on the quoted pair (e.g. USDT,BTC,ETH), as a separate White List (e.g.: BTCUSDT, BNBETH), as well as a Black List (e.g. XRPPAX, BTCDAI) to exclude certain trading pairs.

Market Type: allows the user to select the desired market type for monitoring: Spot/USDT-M/COIN-M.

Quote Assets: quoted asset (For example usdt or btc). If you want to trade the whole market to Tether currency, specify usdt.

White list: currency pairs of the «white list». If you fill this field, you should leave the item «Combined by Quoted Pair» empty! Suppose you want to trade only two pairs BTCUSDT and ETHUSDT, then specify them in this field separated by commas. Trading on other pairs will not be performed. Format — btcusdt, ethusdt, etc.. Followed by Enter key on the keyboard

Black List: currency pairs of the «black list». Let’s assume that in the field «Quote Assets» you specified the quoted asset usdt, but you do not want to trade on currency pairs BTCUSDT and ETHUSDT, then specify them separated by commas in the Blacklist field. Format — btcusdt, ethusdt, etc. Followed by Enter key on the keyboard

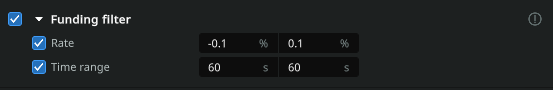

Funding rate filter (funding)

Specify the range of the funding rate in which the algorithm will work.

Funding rate time filter

Specify the range of the funding rate and the time BEFORE the funding rate is paid after which the algorithm will send signals and the time AFTER the funding rate is paid after which the algorithm will pause.

(Read more about the financing rate: https://www.youtube.com/watch?v=4vzkgi_7knA )

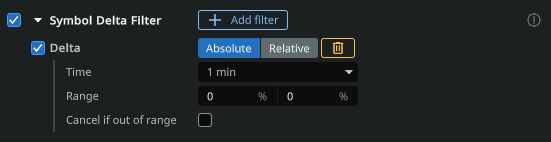

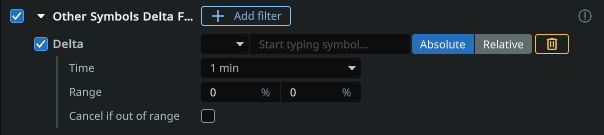

Delta filters by market

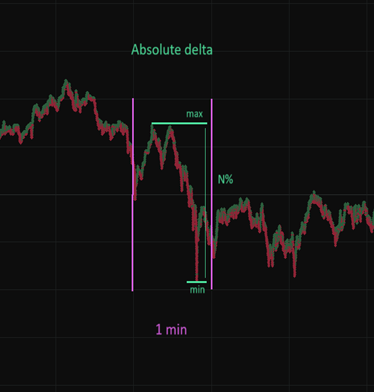

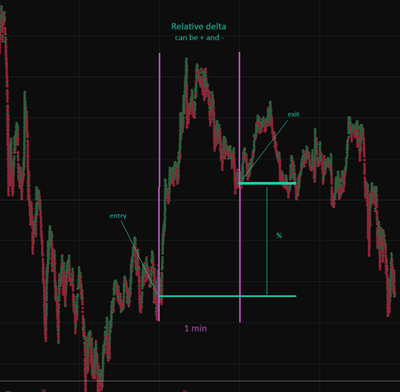

Enables/disables delta filters for each coin for which the algorithm is configured to monitor. This option allows you to add one or more filters, which can differ by time interval and delta range. The delta range can be relative (if values are entered with a «-» sign) or absolute (values are entered as positive integers) and must be entered from smaller (left field) to larger (right field) values.

Use absolute or relative delta: deltas must be specified in the «range» field. Absolute delta can only have positive values. When using Relative delta, the values can be negative, e.g. from -1.5% to -0.5% . Regardless of type of delta, the values must be introduced from lowest (left) to highest (right)

- Time: timeinterval of the delta, currency pairs (which will be selected given the quoted currency, «white list», «black list» data). You can choose one of the proposed options. In the future, the limits of the minimum and maximum delta of currencies will be based on this interval.

- Cancel if out of range: ifchecked, orders in this algorithm will be canceled when deltas move out of the selected range.

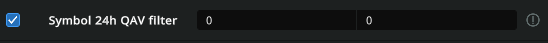

Symbol 24h Quote Asset Volume filter

Filter markets by their daily volume. Specify values by quota pair (note for BTCUSDT, BNBUSDT markets, volumes are specified in USDT). Specify a range to indicate the conditions that satisfy you. Lesser value in the left field, larger value in the right field

- Range: specify the range of minimum and maximum volume for 24 hours, currency pairs (which will be selected taking into account the data of the quoted currency, «white list», «black list»). If the volume of the selected currency pair is less than the set value in the left field or higher than the value in the right field, the algorithm will not monitor the trading pair that violates this specific parameter. You can view the volumes in the client — «Market Watcher» tab.

Delta filters

Enables/disables delta filters for a specific coin that the algorithm will check to determine whether or not to monitor a specific coin pair. This option allows you to add one or more coins that can be assigned different time frames and delta ranges to check that will determine whether or not a coin will be monitored or not. The delta range can be relative (if values are entered with a «-» sign) or absolute (values are entered as positive integers) and must be entered from smaller (left field) to larger (right field).

- Trading pair: a trading pair relative to the deltas of which the filter will be used. For example, BTCUSDT.

- Time: thetime interval of the BTC currency delta. You can choose one of the proposed options. In the future, the minimum and maximum BTC delta limits will be based on this interval.

- Range: Specify the range of minimum and maximum BTC delta. From N1% to N2%. If the BTC delta is outside the selected range, the algorithm will not work and orders will not be placed on the selected pairs. You can view BTC deltas in the client — «Market Watch» tab.

- Cancel if out of range: ifchecked, orders in this algorithm will be canceled when deltas move out of the selected range.

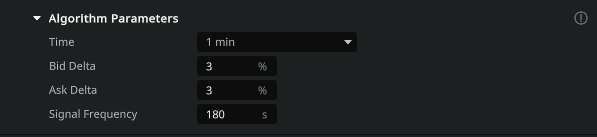

Algorithm parameters

Specify the frequency of the second signal for the same market. Select a value for the Bid Delta (monitor price increase) and Ask Delta (monitor price decrease) values to receive signals as soon as the last price in the market goes outside the limits specified in this value in relation to the one-minute average price.

- Time: Select the time period to analyze. You can choose one of the available options.

- Ask delta: specify by how many percent the price will decline relative to the average price, for the selected period in the «time” period.

- Bid delta: indicate by how many percent the price will increase relative to the average price, for the selected period in the «time period».

- Signal frequency: how often to repeat notifications of algorithm triggering, specified in seconds.

After saving, you can find this algorithm in the Algorithms tab.

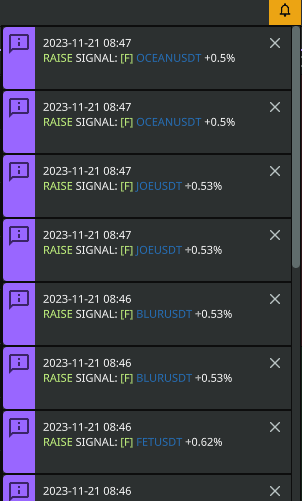

After the algorithm is triggered when the price goes up or down by a specified percentage, you will receive notifications in «Alerts» — at the top right of the MoonTrader main window, the bell icon.

If you have ticked the «Open chart on Trigger» option, charts for triggered pairs will be opened additionally.